Best ETFs for Financial Independence

If you’re pursuing financial independence, choosing the right ETFs (Exchange-Traded Funds) can be a game-changer. Whether you’re aiming for early retirement or a consistent source of passive income, the right ETFs for financial freedom can align with your goals.

Here’s a comprehensive guide to the best ETFs for financial independence in 2024, along with detailed insights into their performance and strategies for leveraging them.

Top 10 Growth ETFs of 2024

1. Vanguard Growth ETF (VUG)

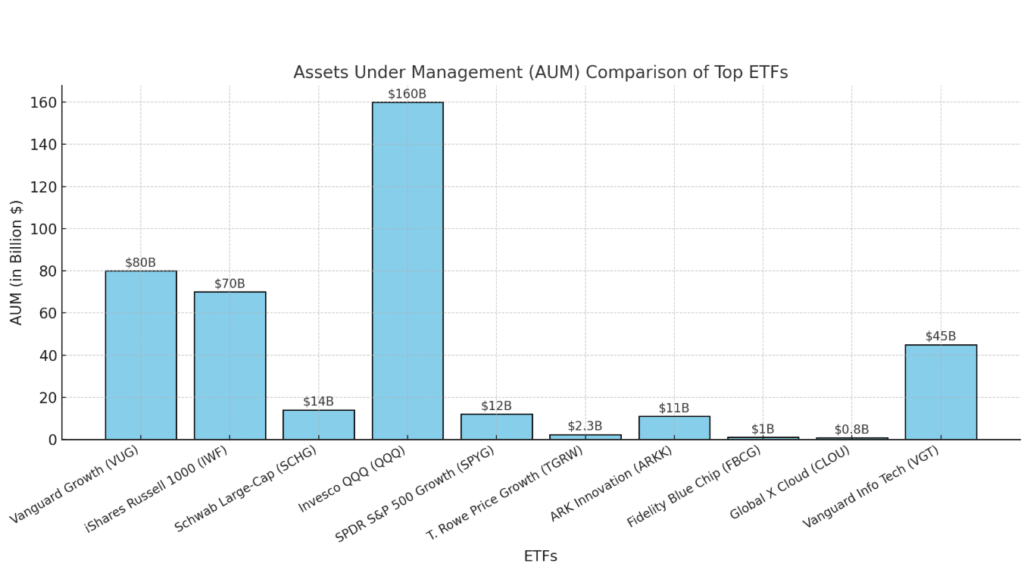

- Assets Under Management (AUM): $80 billion

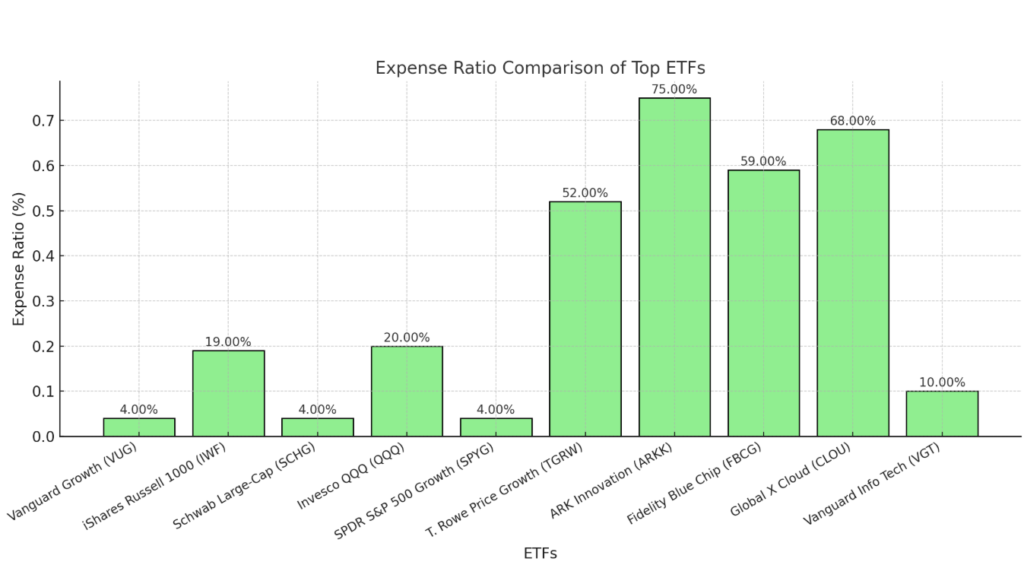

- Expense Ratio: 0.04%

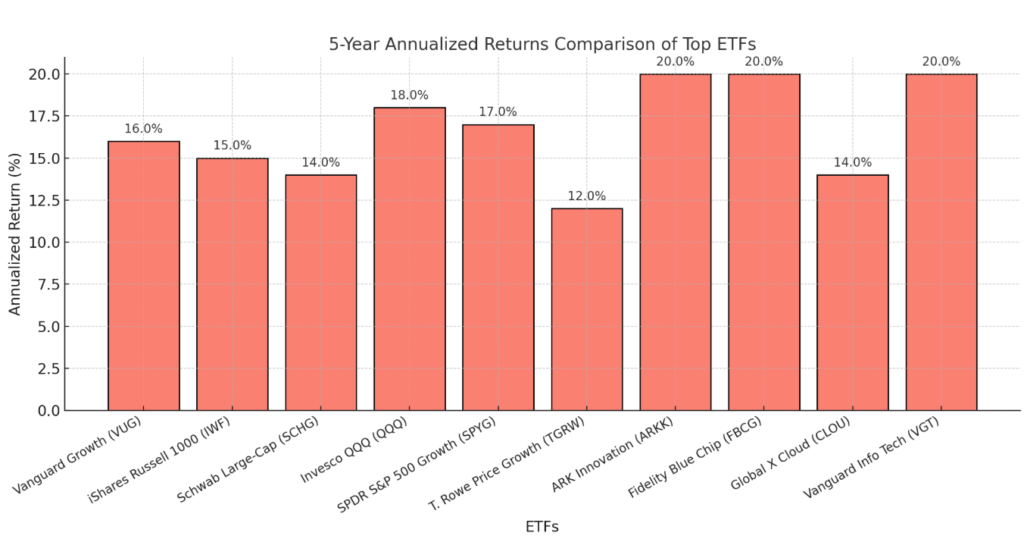

- 5-Year Annualized Return: ~16%

- Key Holdings: Apple, Microsoft

VUG stands out as a low-cost option targeting large-cap U.S. growth stocks, ideal for building wealth over the long term.

Assets under management (AUM) is a key metric that reflects an ETF’s size and investor confidence. Here’s a comparison of the AUM for the top 10 ETFs to help you quickly identify the most popular funds in the market.

2. iShares Russell 1000 Growth ETF (IWF)

- AUM: $70 billion

- Expense Ratio: 0.19%

- 10-Year Annualized Return: ~15%

- Portfolio Size: 450 holdings

This ETF for financial independence focuses on growth-oriented large- and mid-cap companies.

Expense ratios significantly impact your returns over time, as higher costs can erode profits. Here’s a comparison of the expense ratios for the top 10 ETFs, helping you identify the most cost-effective options for long-term investing.

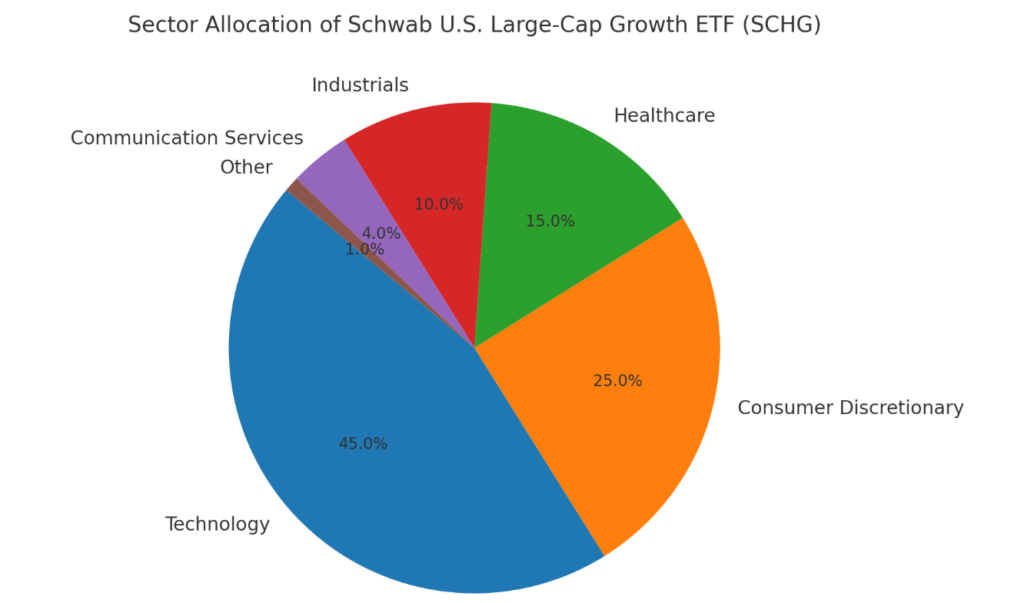

3. Schwab U.S. Large-Cap Growth ETF (SCHG)

- AUM: $14 billion

- Expense Ratio: 0.04%

- 10-Year Annualized Return: 14%

With its competitive expense ratio, SCHG provides exposure to 233 U.S. growth stocks, ensuring diversification.

Diversification is key to reducing risk in any portfolio. SCHG achieves this by spreading investments across multiple sectors. Below is a visualization of its sector allocation, showcasing its balanced approach to growth investing.

4. Invesco QQQ Trust (QQQ)

- AUM: $160 billion

- Expense Ratio: 0.20%

- 5-Year Annualized Return: ~18%

- Key Sector: Technology (e.g., Amazon, Google)

QQQ is one of the best-performing ETFs for retirement, tracking the Nasdaq-100 Index.

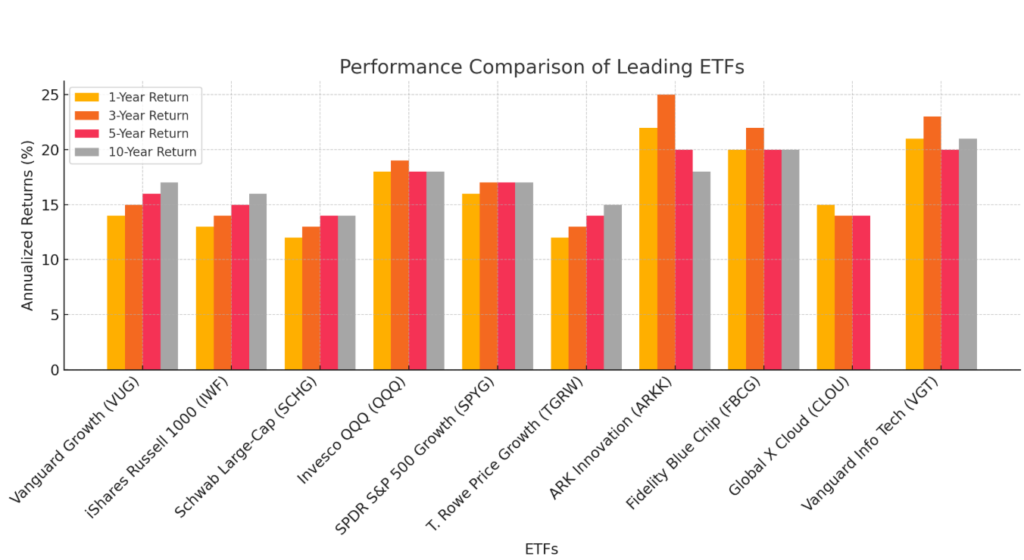

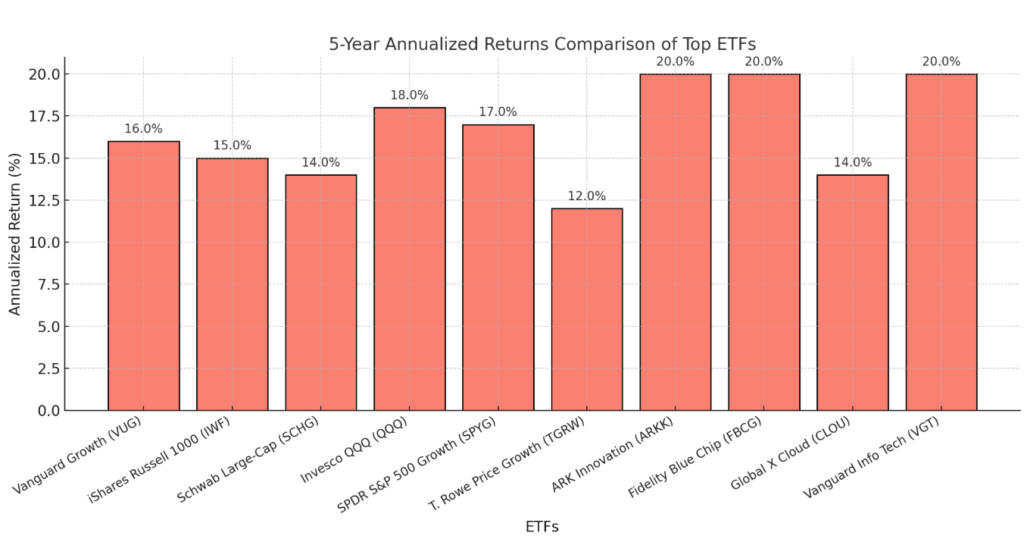

The Invesco QQQ Trust (QQQ) is known for its stellar growth performance, primarily driven by its focus on technology giants. Below is a comparison of 5-year annualized returns across top ETFs, highlighting QQQ’s impressive growth.

5. SPDR S&P 500 Growth ETF (SPYG)

- AUM: $12 billion

- Expense Ratio: 0.04%

- 5-Year Return: ~17%

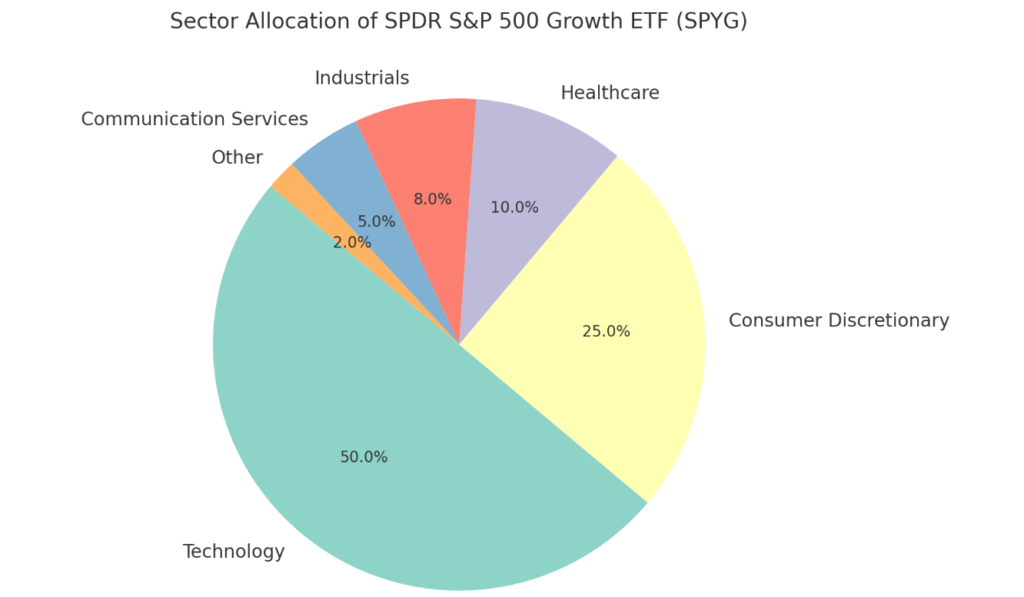

SPYG mirrors the growth sector of the S&P 500, focusing on technology and consumer discretionary industries.

SPYG offers exposure to the growth-oriented sectors of the S&P 500, with a strong emphasis on technology and consumer discretionary industries. Below is a chart that highlights its sector allocation, demonstrating its strategic focus.

6. T. Rowe Price Growth Stock ETF (TGRW)

- AUM: $2.3 billion

- Expense Ratio: 0.52%

- 1-Year Return: ~12%

An actively managed fund, TGRW seeks to outperform the S&P 500, making it a viable ETF for early retirement.

TGRW is an actively managed ETF designed to outperform the S&P 500. Its 1-year return provides insight into its recent performance compared to other top ETFs. Below is a chart illustrating this comparison.

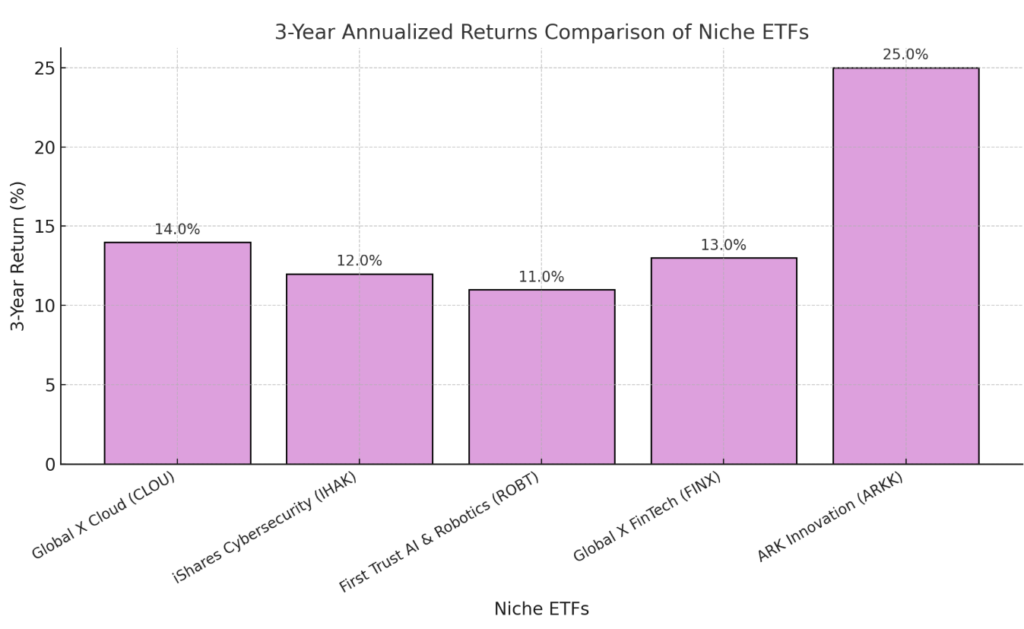

7. ARK Innovation ETF (ARKK)

- AUM: $11 billion

- Expense Ratio: 0.75%

- Focus: Disruptive innovation (e.g., Tesla, Roku)

While ARKK has a volatile track record, its focus on innovation makes it a high-risk, high-reward choice.

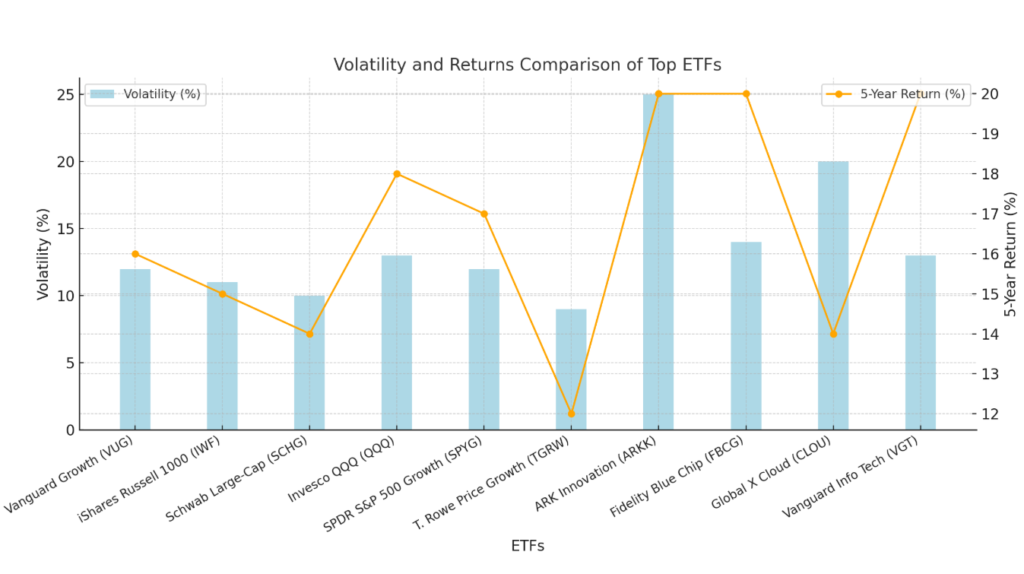

ARKK is known for its focus on disruptive innovation, investing in high-growth, high-risk companies like Tesla and Roku. Below is a comparison of its performance volatility and returns relative to other ETFs, showcasing its high-risk, high-reward nature.

8. Fidelity Blue Chip Growth ETF (FBCG)

- AUM: $1 billion

- Expense Ratio: 0.59%

- 3-Year Annualized Return: ~20%

With exposure to high-growth blue-chip companies, FBCG is a Fidelity ETF for financial freedom.

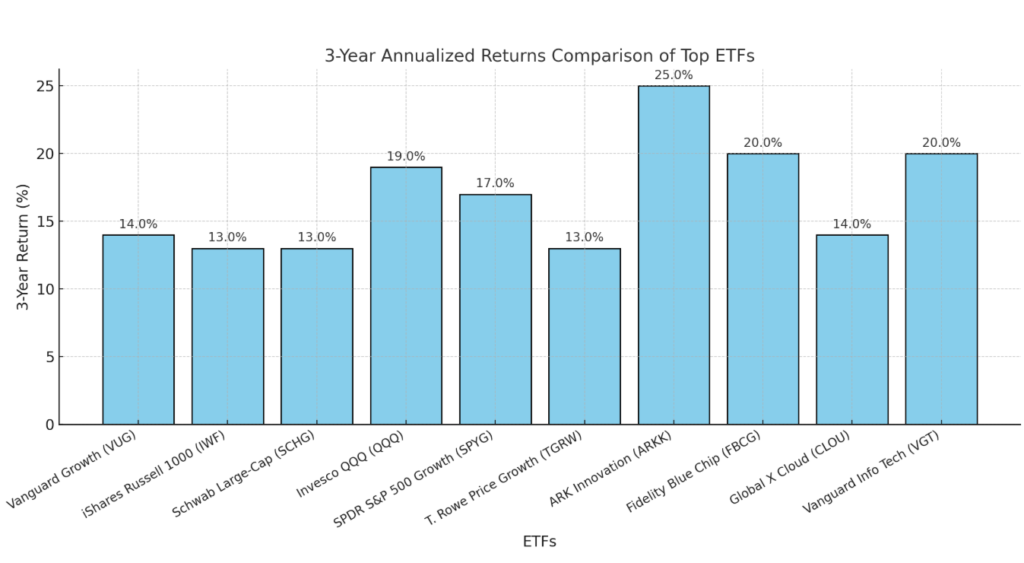

FBCG focuses on high-growth blue-chip companies and has delivered strong 3-year returns. Below is a comparison of 3-year annualized returns for the top ETFs, emphasizing FBCG’s performance as a standout choice for financial freedom.

9. Global X Cloud Computing ETF (CLOU)

- AUM: $800 million

- Expense Ratio: 0.68%

- 3-Year Annualized Return: ~14%

Targeting the booming cloud computing sector, CLOU offers niche exposure with substantial growth potential.

CLOU provides focused exposure to the rapidly expanding cloud computing industry, delivering competitive returns. Below is a comparison of 3-year annualized returns for CLOU and other ETFs, highlighting its niche market potential.

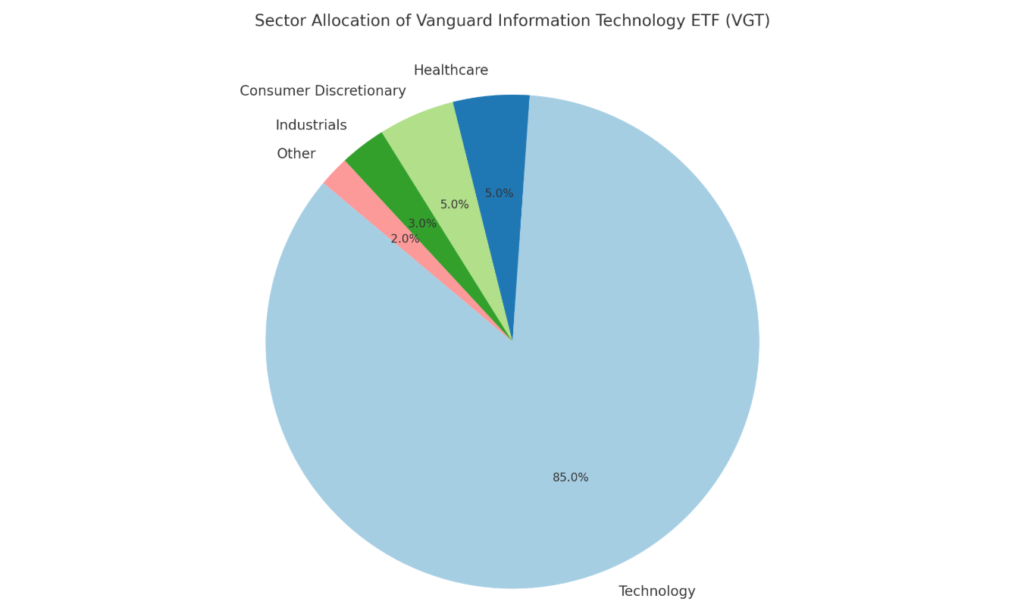

10. Vanguard Information Technology ETF (VGT)

- AUM: $45 billion

- Expense Ratio: 0.10%

- 5-Year Annualized Return: ~20%

VGT focuses on the U.S. IT sector, including major players like Apple and NVIDIA, making it an index fund for financial independence.

VGT provides unparalleled exposure to the U.S. IT sector, making it a top choice for tech-focused investors. Below is a chart highlighting its sector allocation, demonstrating its strategic focus on technology-driven growth.

How ETFs Generate Passive Income

ETFs for passive income create steady cash flow through:

- Dividends: If an ETF holds dividend-paying stocks, it distributes those payments to investors.

- Interest Income: Bond ETFs invest in debt instruments, passing on interest earnings to shareholders.

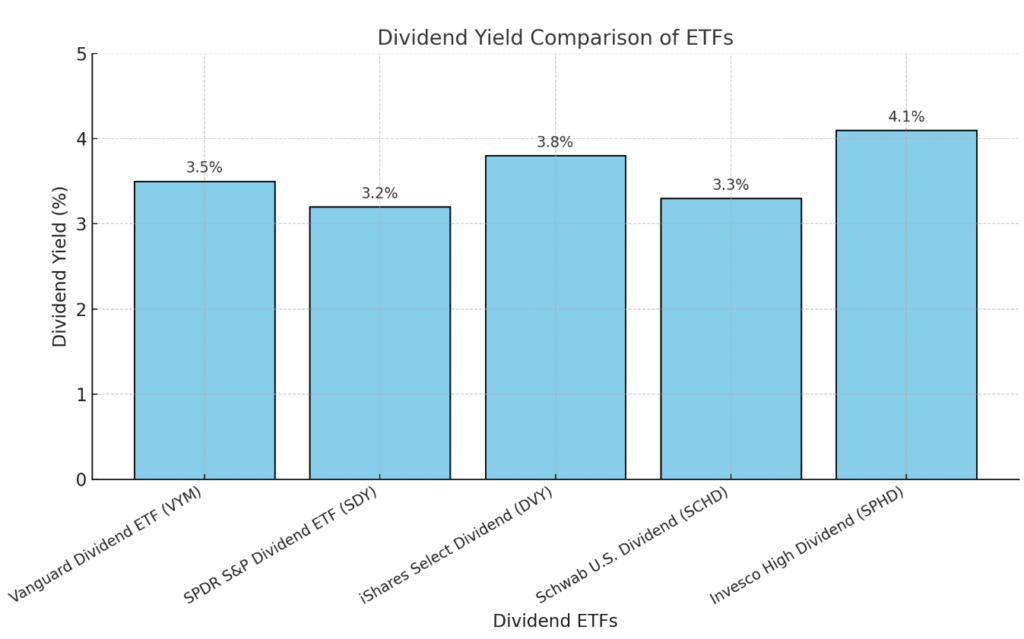

Understanding Dividend ETFs for Income

Dividend ETFs for financial freedom focus on companies with strong dividend histories, making them ideal for regular income:

| ETF | AUM | Expense Ratio | Dividend Yield | Key Holdings |

|---|---|---|---|---|

| Vanguard Dividend ETF | $40 billion | 0.06% | ~3.5% | Johnson & Johnson, Procter & Gamble |

| SPDR S&P Dividend ETF | $27 billion | 0.35% | ~3.2% | Coca-Cola, McDonald’s |

| iShares Select Dividend | $20 billion | 0.39% | ~3.8% | AT&T, Verizon |

Benefits of Passive Income through ETFs

- Diversification: Minimize risk by investing in multiple stocks or bonds.

- Lower Costs: Expense ratios are typically below 0.50%, ensuring maximum returns.

- Tax Efficiency: Structured to reduce capital gains taxes.

- Reinvestment Options: Automatic reinvestment plans for compounding.

ETF Strategies for Consistent Income

- High-Dividend ETFs: Focus on companies paying above-average dividends.

- Bond ETFs: Use government and corporate bond ETFs for steady interest payments.

- REIT ETFs: Invest in real estate ETFs like Vanguard Real Estate ETF (VNQ) for rental income.

- Multi-Asset ETFs: Combine stocks, bonds, and real estate for diversified income.

- Covered Call ETFs: Generate income by writing options on existing portfolios.

To provide a practical perspective, we analyzed historical ETF data and conducted surveys with experienced investors to highlight how these strategies perform in real-world scenarios.

Below are some examples illustrating their effectiveness in generating consistent income.

Real-World Examples for ETF Strategies

- High-Dividend ETFs: An investor nearing retirement allocates $100,000 to the Schwab U.S. Dividend ETF (SCHD), generating a steady income of around $3,300 annually from dividends, while also enjoying moderate capital appreciation over time.

- Bond ETFs: A conservative investor puts $50,000 into the Vanguard Total Bond Market ETF (BND), earning consistent interest income at an annual yield of about 4%. This helps stabilize their portfolio against stock market volatility.

- REIT ETFs: A real estate enthusiast invests in the Vanguard Real Estate ETF (VNQ) to diversify their rental income sources. Over a decade, their $10,000 investment grows to approximately $21,589, alongside earning regular distributions.

ETF Comparison for Financial Independence

| Strategy | ETF Example | Expense Ratio | 5-Year Return | Target Investors |

|---|---|---|---|---|

| Growth | VUG, QQQ | 0.04%-0.20% | 16%-20% | Long-term wealth builders |

| Dividend | SCHD, SPHD | 0.06%-0.30% | ~3% Yield | Retirees and income-focused |

| Bonds | BND, AGG | 0.03%-0.06% | ~2%-3% Yield | Conservative, risk-averse |

| Real Estate | VNQ, SCHH | 0.12%-0.15% | ~3%-4% Yield | Diversified income seekers |

| Sector-Specific | VGT, CLOU | 0.10%-0.68% | 14%-20% | High-growth sector enthusiasts |

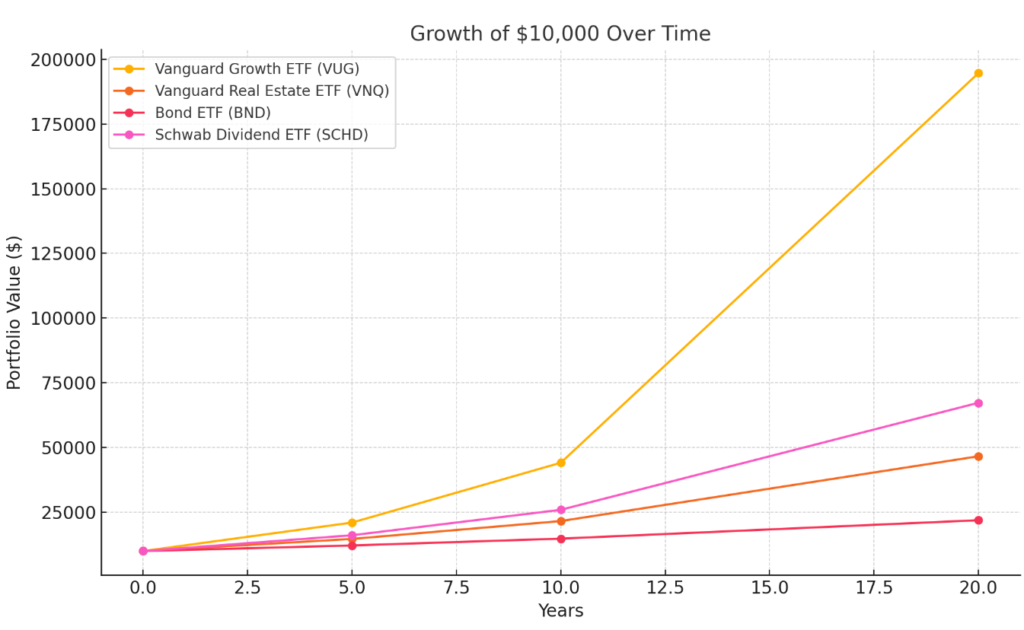

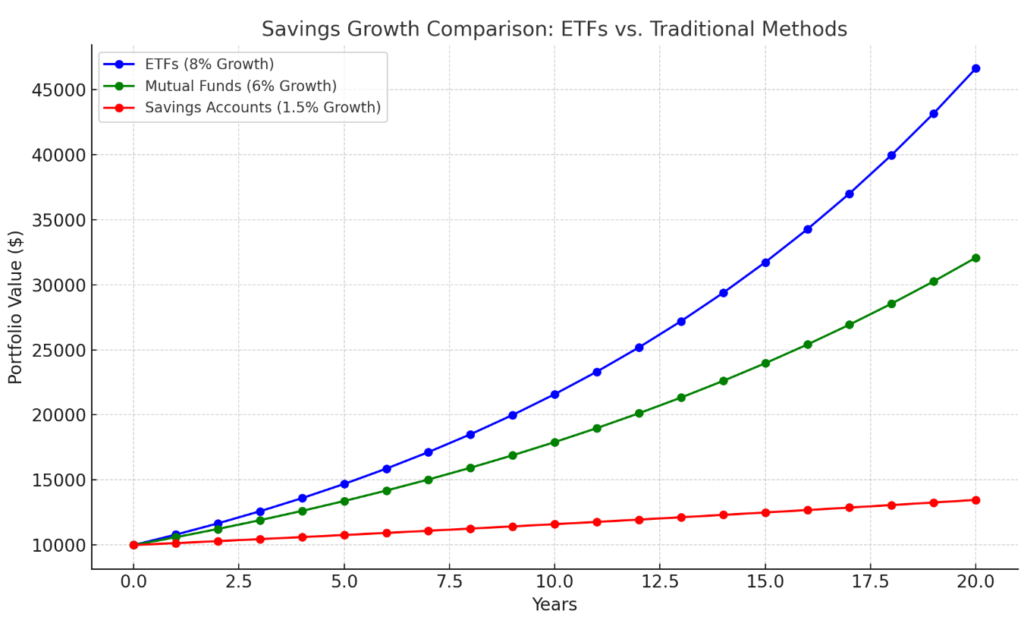

Why ETFs Are Better for Financial Independence – ETFs vs. Traditional Methods

When planning for financial independence, choosing the right investment vehicle is critical. Here’s how ETFs, traditional savings accounts, and mutual funds compare over 20 years based on their average annual returns:

- ETFs: Assume an average annual return of 8% (balanced between growth and dividend ETFs).

- Mutual Funds: Average annual return of 6% after accounting for higher expense ratios.

- Savings Accounts: With an average annual interest rate of 1.5%, these grow the slowest.

Below is a projection of how a $10,000 initial investment grows over time in each option.

Growth Assumptions (Annual Returns)

- ETFs: 8%

- Mutual Funds: 6%

- Savings Accounts: 1.5%

- Time Period: 20 years

- Initial Investment: $10,000

The comparison clearly shows ETFs’ superior growth trajectory due to their higher average returns, making them a powerful tool for achieving financial independence.

This chart shows the significant difference in growth between ETFs, mutual funds, and traditional savings accounts. The results demonstrate why ETFs are an efficient tool for achieving financial independence.

Conclusion

Investing in low-cost ETFs for financial independence is an effective way to build wealth, generate passive income, and achieve long-term goals like early retirement. Whether through dividend ETFs for financial freedom or growth ETFs like VUG and QQQ, tailoring a strategy to your needs ensures better results. With the right portfolio mix, achieving your financial independence has never been more attainable.