Best Dividend Stocks for Passive Income

Investing in dividend stocks is a proven strategy for generating passive income and building long-term wealth. In this guide, we’ll explore the best dividend stocks for financial independence, highlight monthly dividend stocks, and provide actionable tips to optimize your portfolio for consistent returns.

Let’s dive into the details to help you maximize your dividend income.

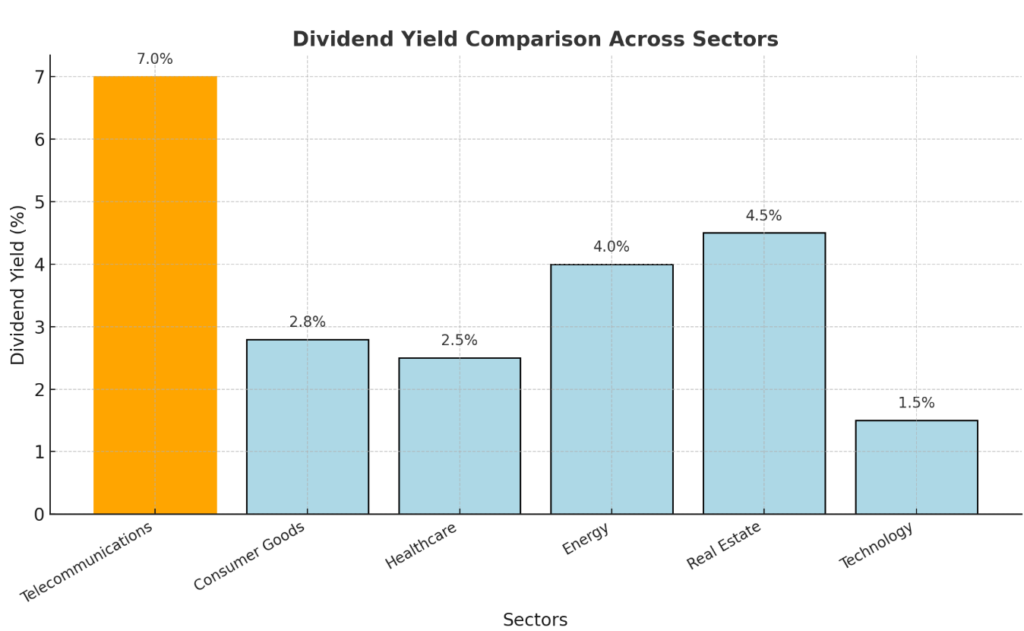

| Stock | Sector | Dividend Yield | Dividend History |

|---|---|---|---|

| AT&T (T) | Telecommunications | 7% | Over 30 years |

| Johnson & Johnson (JNJ) | Healthcare | 2.5% | Increased for 58 years |

| Procter & Gamble (PG) | Consumer Goods | 2.3% | Paid since 1891, increased 63 years |

| Chevron (CVX) | Energy | 4% | Reliable payer for over 100 years |

| Realty Income (O) | Real Estate | 4.5% | Known as “The Monthly Dividend Company” |

Best Dividend Stocks for Passive Income

AT&T Inc. (T)

- Sector: Telecommunications

- Dividend Yield: Approximately 7%

- Dividend History: Consistent payer for over 30 years.

AT&T offers one of the highest dividend yields among reliable dividend stocks for long-term income, appealing to income-focused investors. Despite challenges in the telecommunications sector, its expansion into digital services ensures a stable dividend.

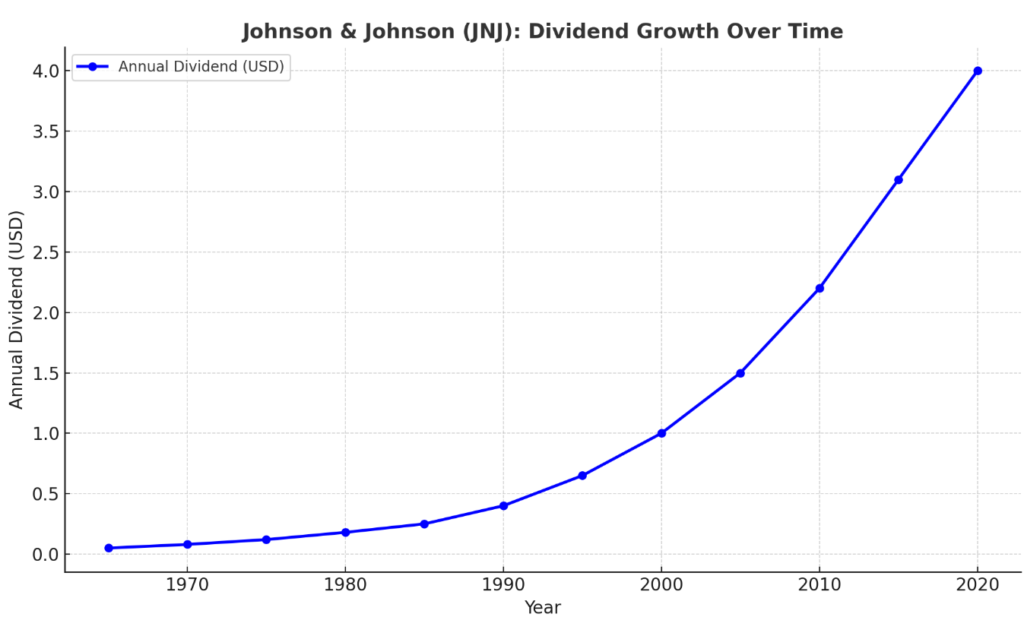

Johnson & Johnson (JNJ)

- Sector: Healthcare

- Dividend Yield: Around 2.5%

- Dividend History: Increased dividends for 58 consecutive years.

As a dividend aristocrat, Johnson & Johnson’s diversified business model and financial stability make it one of the best dividend growth stocks for low-risk passive income.

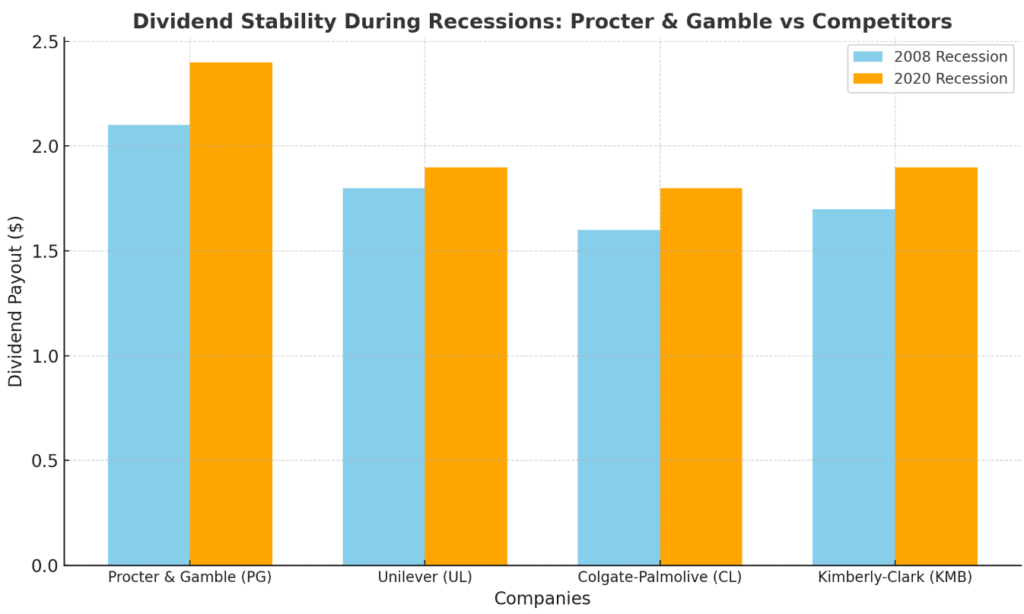

Procter & Gamble (PG)

- Sector: Consumer Goods

- Dividend Yield: About 2.3%

- Dividend History: Paid dividends since 1891 and increased annually for 63 years.

Procter & Gamble is a top choice for blue-chip dividend stocks, offering stability and consistent dividend growth. It’s an excellent option for those seeking safe dividend stocks for retirees.

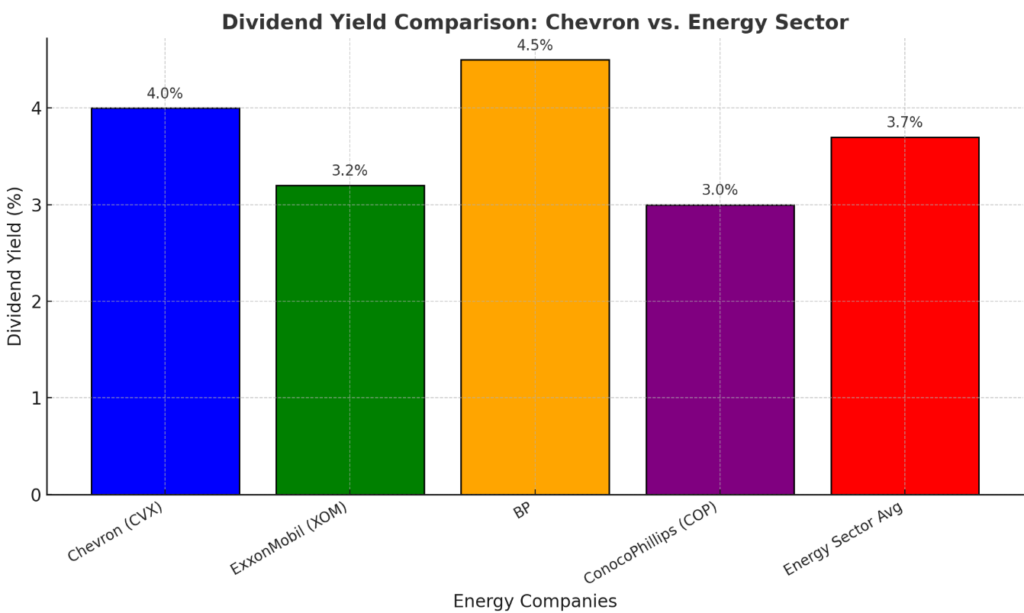

Chevron (CVX)

- Sector: Energy

- Dividend Yield: Approximately 4%

- Dividend History: Reliable payer for over 100 years.

Chevron’s strong cash flow and investments in renewable energy secure its spot as a high-dividend yield stock, ideal for diversified portfolios.

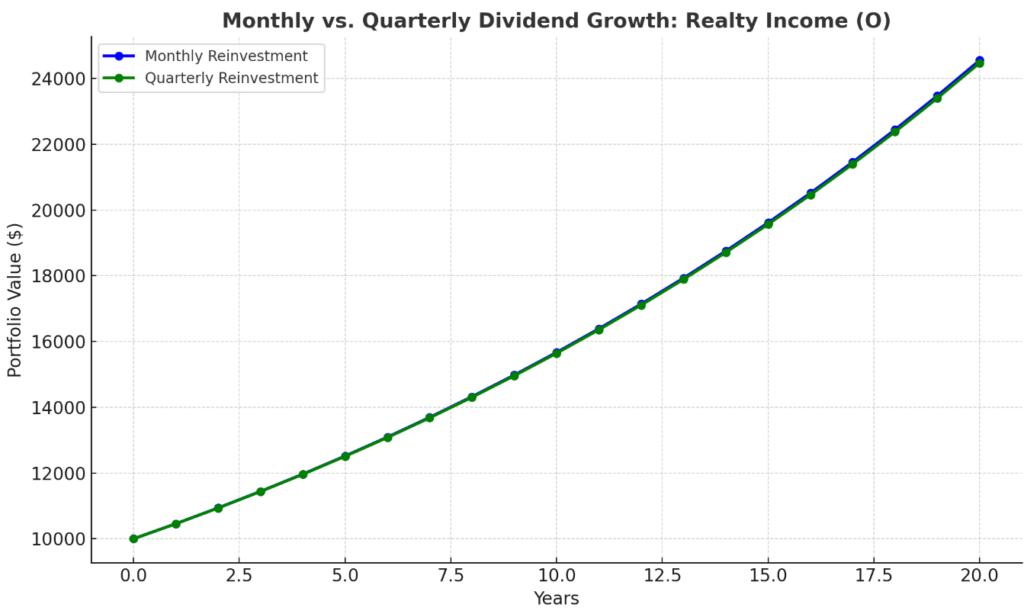

Realty Income Corporation (O)

- Sector: Real Estate

- Dividend Yield: Around 4.5%

- Dividend History: Known as “The Monthly Dividend Company”.

Realty Income is a leader among monthly dividend stocks, offering stable returns from long-term lease agreements. Its consistent payouts make it a great choice for dividend investors seeking financial independence.

PepsiCo (PEP)

- Sector: Consumer Goods

- Dividend Yield: About 2.9%

- Dividend History: Increased dividends for 48 consecutive years.

PepsiCo’s diversification into snacks and beverages ensures stable dividend stocks during a recession, making it a resilient option for passive income portfolios.

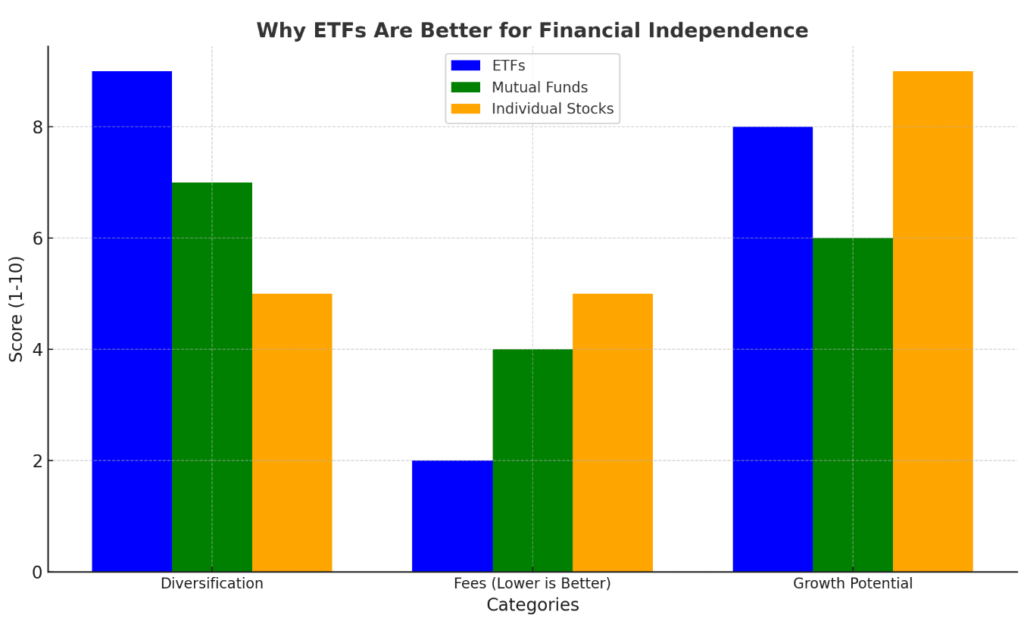

Why ETFs Are Better for Financial Independence

For many, investing in dividend-paying ETFs is a more efficient strategy than picking individual high-yield dividend stocks. Let’s explore why:

- Diversification: ETFs inherently reduce risk by holding stocks from multiple sectors, making them ideal for building a passive income portfolio with dividends.

- Low Fees: Most dividend ETFs have lower expense ratios compared to mutual funds, ensuring more of your income is reinvested.

- Consistent Growth: ETFs like Vanguard Dividend Appreciation ETF (VIG) or Schwab U.S. Dividend Equity ETF (SCHD) consistently outperform savings accounts and mutual funds in terms of returns.

This chart provides a clear comparison of diversification, fees, and growth potential among ETFs, mutual funds, and individual stocks. Based on industry data and investor analysis, ETFs excel in diversification and growth potential while maintaining significantly lower fees, positioning them as a superior choice for achieving financial independence.

Criteria for Choosing the Best Dividend Stocks

To identify the best dividend-paying stocks for beginners or seasoned investors, focus on:

- Dividend Yield: Aim for a balance between yield and sustainability (3%-7%).

- Payout Ratio: Keep it under 60% for non-REITs.

- Dividend Growth: Look for companies with a track record of increasing payouts, such as dividend kings like Coca-Cola or Johnson & Johnson.

- Economic Moat: Companies with strong competitive advantages, like Procter & Gamble, are less likely to cut dividends during downturns.

Tips for Optimizing Your Dividend Strategy

- Use DRIPs: Reinvest dividends to compound your portfolio over time.

- Diversify: Spread your investments across sectors like real estate, energy, and consumer goods.

- Monitor Payouts: Consistent dividends indicate stability; a cut might signal trouble.

- Leverage Tax-Advantaged Accounts: Maximize returns by holding tax-efficient dividend stocks in accounts like IRAs.

Conclusion

Investing in the best dividend stocks for financial independence or dividend ETFs is a proven way to build wealth and achieve financial freedom. By focusing on high-dividend yield stocks, leveraging dividend reinvestment plans, and diversifying your portfolio, you can create a reliable income stream. Start building your passive income portfolio today with the strategies outlined here!