Best Credit Cards for Rewards and Savings

Reward credit cards are an excellent way to make your everyday spending work harder, turning routine purchases into savings, travel perks, or cash rewards. To maximize these benefits, it’s essential to align your financial strategy with your long-term goals.

Tools like a FIRE Calculator can help you assess how these rewards fit into your broader financial independence and early retirement plans, ensuring your credit card choices support your journey toward financial freedom.

By finding the perfect card tailored to your spending habits and goals, you can unlock significant perks that seamlessly complement your lifestyle.

Best Credit Cards for Cash Back

Cash back cards are perfect for earning rewards on everyday expenses. Here are the top options for both flat-rate and bonus category cash back:

Flat-Rate Cash Back Cards

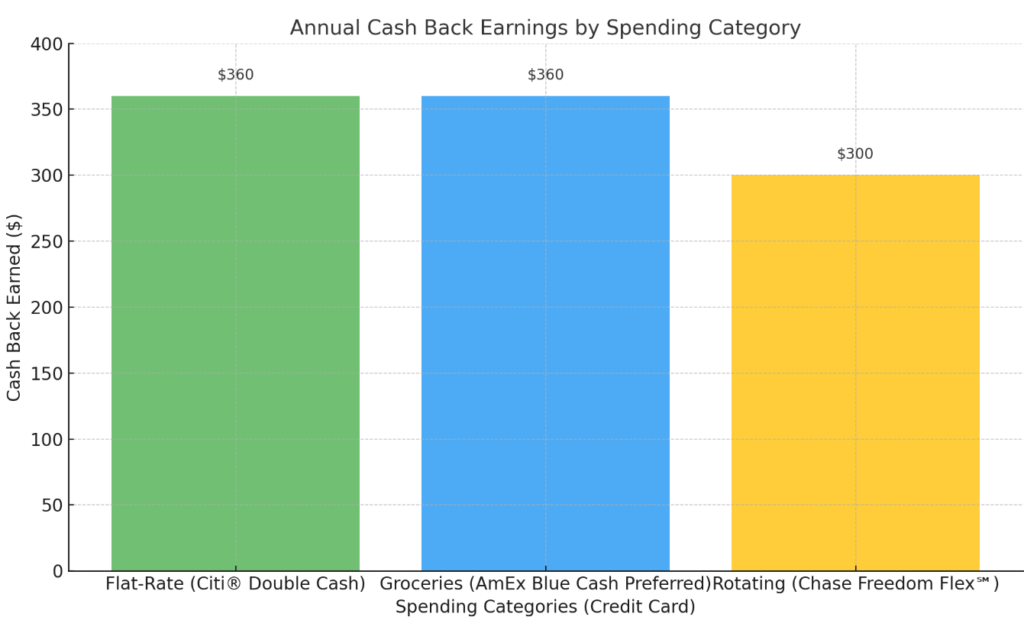

Citi® Double Cash Card

- Rewards: 2% on all purchases (1% when you buy, plus 1% when you pay).

- Why It’s Great: A simple structure ideal for consistent spenders.

- Example: Spend $1,500 monthly, and earn $360 annually without tracking categories.

Bonus Category Cash Back Cards

Blue Cash Preferred® Card from American Express

- Rewards: 6% at U.S. supermarkets (up to $6,000/year, then 1%), 6% on select streaming subscriptions.

- Why It’s Great: Perfect for families with high grocery bills.

- Example: Spend $500 monthly on groceries, and earn $360 annually.

Chase Freedom Flex℠

- Rewards: 5% on rotating categories each quarter (up to $1,500, then 1%).

- Why It’s Great: Offers flexibility with categories like gas, dining, and shopping.

- Example: Earn $300 annually by maximizing quarterly categories.

Annual Cash Back Earnings by Spending Category.

Cash Back Credit Cards

| Credit Card | Reward Type | Cash Back Rate | Notable Features |

|---|---|---|---|

| Citi® Double Cash Card | Flat-rate | 2% on all purchases | Simple, no category tracking |

| Blue Cash Preferred® Card from AmEx | Bonus category | 6% at U.S. supermarkets | High rewards for families |

| Chase Freedom Flex℠ | Rotating bonus | 5% on rotating categories | Flexible rewards for diverse spending |

Best Credit Cards for Travel Rewards

For frequent travelers, these travel rewards credit cards provide exceptional benefits:

Chase Sapphire Preferred® Card

- Rewards: 2x points on travel and dining.

- Why It’s Great: Points redeemed through Chase Ultimate Rewards are worth 25% more.

- Example: Spend $10,000 annually on travel and dining, and earn 25,000 points, worth $312.50 toward travel.

Capital One Venture Rewards Credit Card

- Rewards: 2x miles on all purchases.

- Why It’s Great: Flexible redemption with miles transferable to 15+ loyalty programs.

- Example: Spend $15,000 annually, and earn 30,000 miles, redeemable for $300+ in travel.

American Express® Gold Card

- Rewards: 4x points at restaurants and 3x points on flights.

- Why It’s Great: Transfer points to airlines and hotels for added flexibility.

- Example: Dining expenses of $8,000 annually yield 32,000 points, worth $640 with transfer partners.

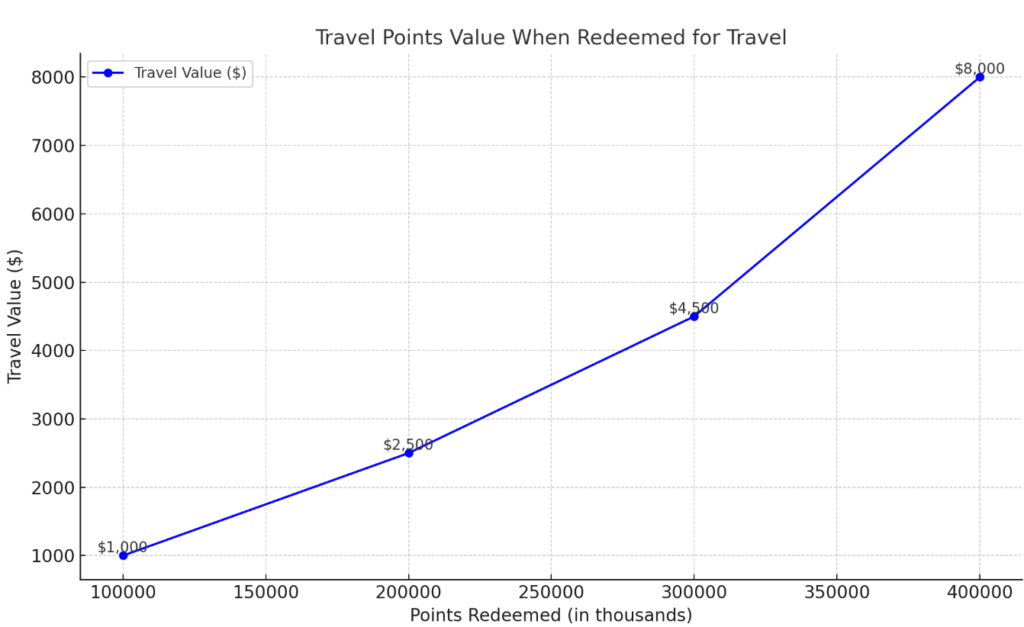

Here is the line graph showcasing Travel Points Value When Redeemed for Travel. The chart demonstrates how the redemption value increases with the number of points redeemed and the value per point:

- 1 cent per point: $1,000 for 100,000 points.

- 1.25 cents per point: $2,500 for 200,000 points.

- 1.5 cents per point: $4,500 for 300,000 points.

- 2 cents per point: $8,000 for 400,000 points.

Travel Rewards Credit Cards

| Credit Card | Points on Travel/Dining | Additional Perks |

|---|---|---|

| Chase Sapphire Preferred® Card | 2x points | 25% more value via Chase Ultimate Rewards |

| Capital One Venture Rewards Card | 2x miles | Global Entry/TSA PreCheck fee credit |

| American Express® Gold Card | 4x points at restaurants | No foreign transaction fees, flexible transfers |

Best Cards for Specific Needs

Large Families

- Card: Blue Cash Preferred® Card from American Express

- Benefits: 6% cash back at U.S. supermarkets (on up to $6,000/year).

- Example: A $1,000 monthly grocery bill generates $720 annually in rewards.

Business Expenses

- Card: Ink Business Preferred® Credit Card

- Benefits: 3x points on travel, shipping, and internet (up to $150,000/year).

- Example: Spend $50,000 on eligible business expenses, and earn 150,000 points, worth $1,875 for travel.

Students

- Card: Discover it® Student Cash Back

- Benefits: 5% cash back on rotating categories.

- Example: Max out quarterly categories and earn $300 annually.

First-Time Cardholders

- Card: Capital One Platinum Credit Card

- Benefits: No annual fee, potential for credit line increases in 6 months.

- Best For: Building credit with minimal risk.

Specific Needs

| Card Type | Credit Card | Key Benefits | Best For |

|---|---|---|---|

| Large Families | Blue Cash Preferred® Card from AmEx | 6% cash back on groceries | High grocery expenses |

| Business Expenses | Ink Business Preferred® Credit Card | 3x points on business expenses | Business owners |

| Students | Discover it® Student Cash Back | 5% cash back on rotating categories | Building credit with rewards |

| First-Time Users | Capital One Platinum Credit Card | No annual fee, credit-building benefits | First-time cardholders |

How to Choose the Right Card?

Understand Your Spending Habits

- Example: If 40% of spending goes toward groceries and dining, opt for a bonus category rewards card.

Consider Fees

- Evaluate whether a card’s rewards outweigh its annual fee.

- Example: Spending $10,000 annually with a $95 annual fee card should yield at least $300+ in rewards to be worthwhile.

Rewards That Match Your Lifestyle

- Travelers should focus on travel rewards credit cards, while casual spenders may benefit more from cashback rewards cards.

Check the Fine Print

- Avoid cards with restrictions like blackout dates or reward expiration.

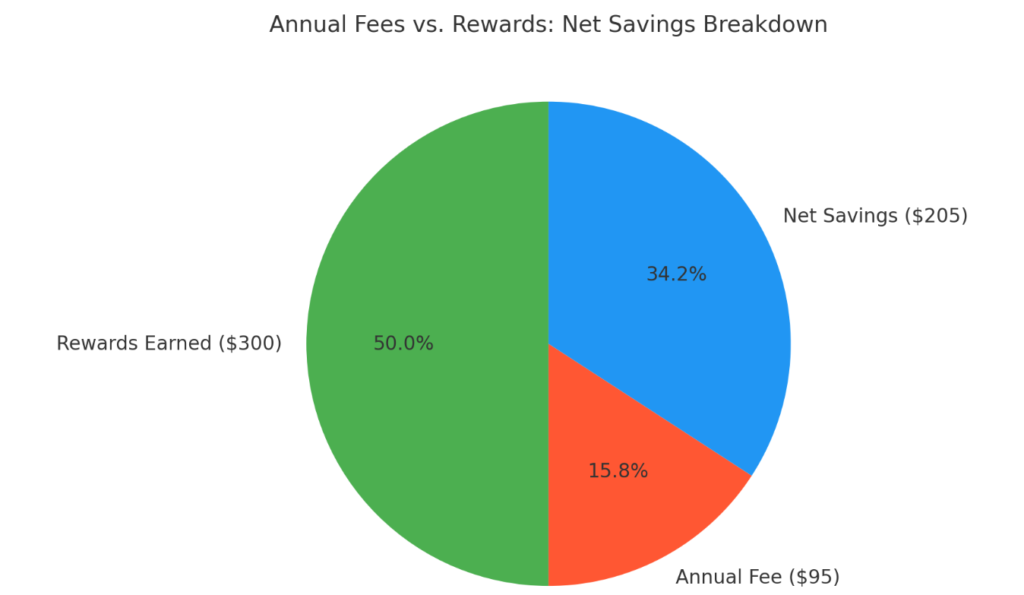

Here is the Chart illustrating the breakdown of Annual Fees vs. Rewards, showing how rewards offset the annual fee:

- Rewards Earned: $300 (68.2%)

- Annual Fee: $95 (21.6%)

- Net Savings: $205 (45.5%)

Conclusion

The right rewards credit card can transform your spending into significant savings. Whether you prefer cashback rewards, travel perks, or specialized benefits, there’s a card for every lifestyle.

To understand how these rewards align with your long-term financial goals, consider using a Coast FIRE Calculator. This tool helps evaluate how your spending and rewards contribute to achieving financial independence while maintaining a comfortable lifestyle.

By analyzing your habits, focusing on rewards that matter, and avoiding hidden pitfalls, you can ensure every dollar you spend brings maximum value.

Start swiping smarter today!